Earn Free BITCOIN Without Investment 2021 (Best Bitcoin mining apps for beginners)

Afterwards, the ongoing increase has invalidated a significant portion of potential bearish counts. Therefore, it is likely that BTC has bottomed.

Cryptocurrency trader @TheTradinghubb outlined two potential counts for BTC, one bullish and the other bearish. In this article, we will take a look at both and determine which is the most likely to transpire.

The only thing that seems certain for the BTC movement is that the decrease from the April 14 all-time high (highlighted) is a five wave bearish impulse. However, it is not certain if that is part of a C wave (white) or if it is the beginning of a new bearish impulse.

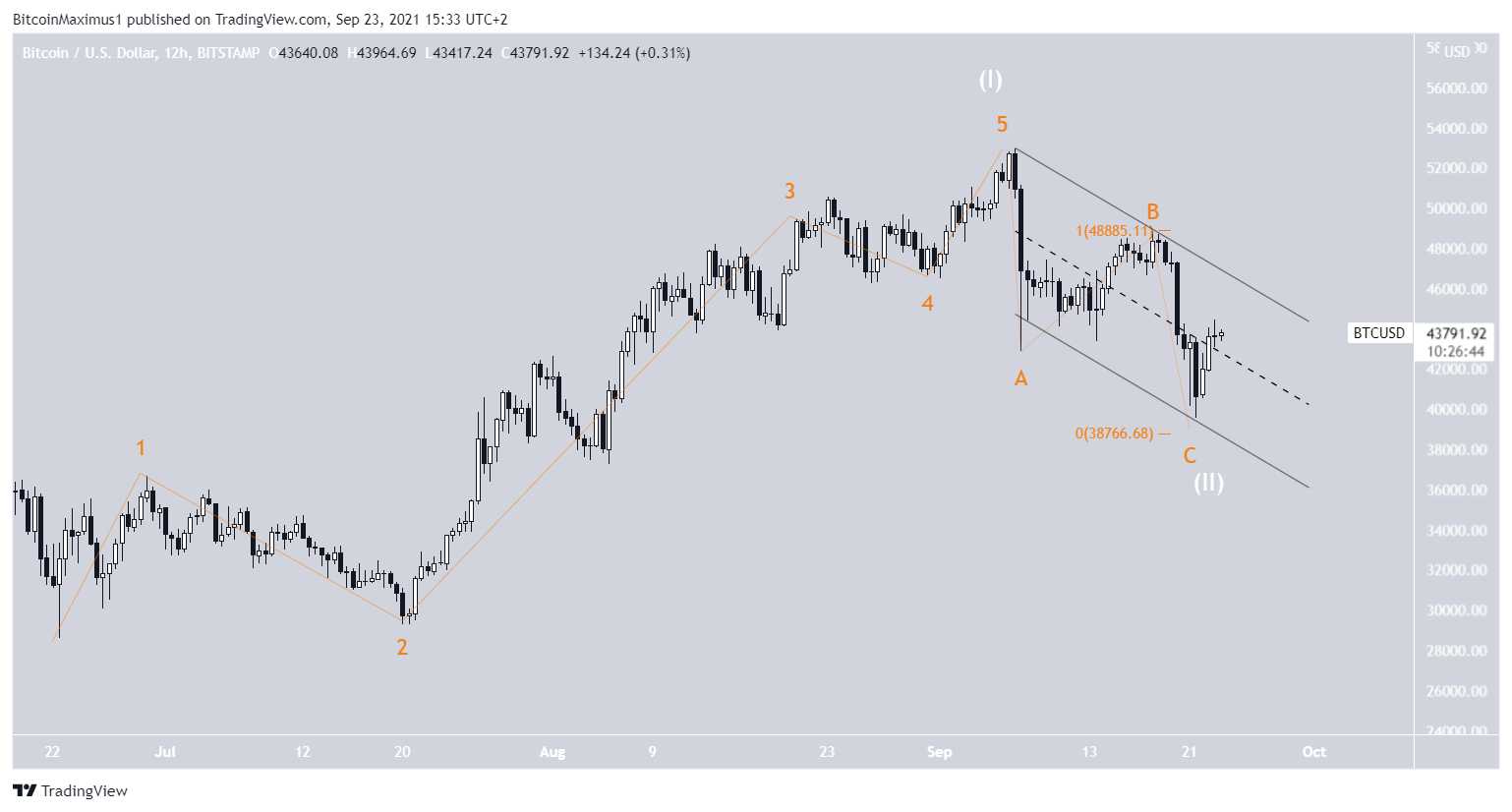

The bullish count indicates that it is a C wave. Therefore, a new impulse (white) began on June 22. The ongoing decrease since Sept 7 was part of wave 2. Afterwards, the bounce on Sept 22 likely marked the end of the correction. The fact that the bounce occurred right at the 0.5 Fib retracement level further solidifies this possibility.

The sub-wave count is given in orange. The aforementioned decrease resembles a textbook A-B-C corrective structure, in which waves A:C had a 1:1 ratio.

Furthermore, the movement is contained inside a descending parallel channel.

The increase above the wave one low at $42,900 (red line) invalidates the majority of potential bear counts, unless this is a massive 1-2/1-2 formation, which seems extremely unlikely.

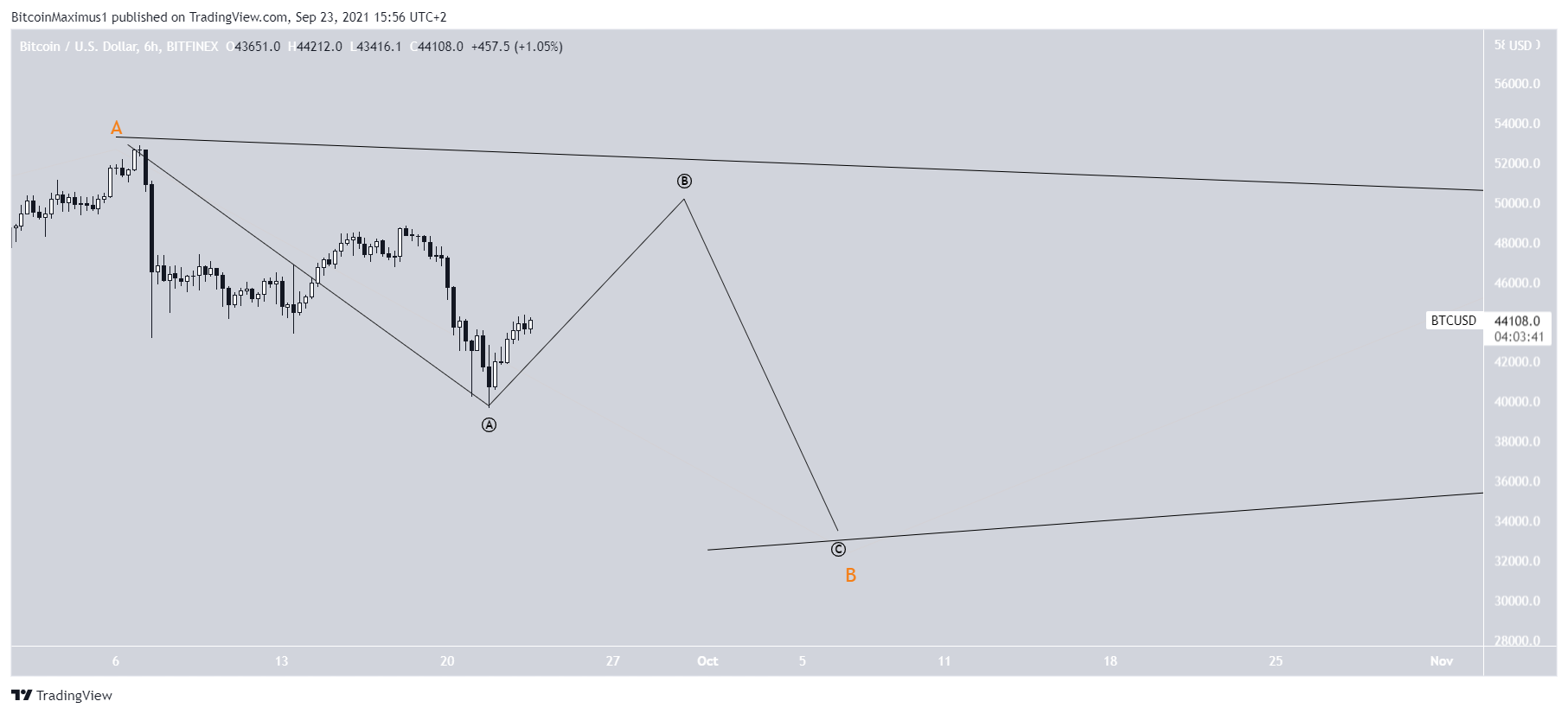

The bearish count suggests that the entire upward movement since June 22 was part of a corrective structure (orange). In this case, another downward movement that takes the price below the June 22 lows would be expected (white).

The issue with this count is the length of the C wave (orange), which is nearly 3.61 times as long as wave A.

Therefore, the only possibility would be that the entire B wave would take the shape of a symmetrical triangle, since extensions are more common in such structures.

However, even if the count proves to be true, an upward movement towards $50,000 would be initially expected before the ensuing drop.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

On this week’s BeInCrypto Video News Show, Jessica Walker investigates the current trend of coordinated pumps organized on social media and via influencers.

The XRP price has been particularly erratic in recent days. The digital currency gained 153% between Jan. 30 and Feb 1, before crashing 51%.

Similarly, unconventional price action in GameStop, Nokia, and Dogecoin may prompt action from global financial regulators.

XRP holders have had it rough since the digital currency’s January 2017 all-time high. Investors have had to watch their holdings depreciate while other cryptocurrencies surpass their all-time highs.

Casting a black cloud over XRP’s future is the US Securities and Exchange Commission (SEC). The financial regulator alleges that Ripple illegally sold XRP as an unregistered security.

As BeInCrypto reported, exchanges have been delisting XRP following the SEC announcement. Grayscale Investments also dropped its XRP Trust, creating additional selling.

The XRP price suddenly started increasing between Jan. 27 and Feb. 1. Similarly, the number of addresses more than doubled over the same period, and social media mentions exploded.

There seem to be two main factors behind the surge in interest – Ripple’s response to the SEC and a coordinated effort to pump XRP on social media. In its rebuttal, Ripple claims that XRP is not a security. The firm, therefore, contends that the SEC should not have jurisdiction over XRP.

The second and arguably more important driver of XRP price was coordinated buying on social media. Inspired by the recent GameStop debacle, XRP community members planned their own pump.

Among those stocks (and cryptos) exhibiting strange behavior in recent days are Nokia, AMC, Blackberry, and Dogecoin. Pumps have been orchestrated in online communities such as subreddits r/WallStreetBets and r/SatoshiStreetBets.

In the GameStop example, the motive was to ‘short squeeze’ Wall Street traders who were attempting to drive GME stock into the ground. The buying pressure of literally millions of Reddit users pumped, leaving shorters out of pocket.

The same tactic was later attempted on other stocks. BeInCrypto recently reported on dogecoin’s (DOGE) own 800% rally. On Twitter, Reddit, and in two Telegram groups (with more than 300,000 combined members), the idea was put forward to buy XRP at exactly 13:30 CET on Feb. 1.

Without the political motive of the GME pump, people front ran the buying event. The XRP price rose from around $0.25 to a brief high above $0.70 between Jan. 28 and Feb. 1. As the 13:30 buying time arrived, many dumped their holdings, and the price plunged back to around $0.35 in hours.

Recent examples of coordinated pumps demonstrate social media’s growing influence on markets. The buying was orchestrated largely on Reddit and Telegram groups.

Similarly, influencers appear to be having a bigger impact on markets than ever. Whether it’s the influence of the collective consciousness in groups like r/WallStreetBets or direct efforts by well-known individuals, the power to influence prices is being harnessed, and in the GME example, weaponized.

Some examples include Tesla and SpaceX CEO Elon Musk changing his Twitter profile description to read ‘bitcoin.’ The price of the leading digital asset rose back above $37,000 on the news.

Musk has also previously created DOGE price pumps. Tweets like the one below show his soft spot for the ‘meme coin’:

Merry Christmas & happy holidays!

Kiss bassist Gene Simmons mentioned both DOGE and XRP investments on Jan. 31. Stressing it was not financial advice, he tweeted:

Not recommending any of these to anyone. But yes, I also bought Dogecoin, XRP and others. Make of it what you will.

With the hive mind moving asset prices, it may only be a matter of time before regulators respond. As CNBC reported, investors are growing increasingly worried about a clampdown.

Several analysts called on the SEC to look into the matter. Dan Lane, an analyst at British trading app Freetrade, told CNBC:

“The reality is that the new brand of charismatic leader has a public platform now and isn’t confined to the boardroom. It’s up to regulators how they deal with that but, eventually, the onus will be on them to update the rule book.”

In the last few years, bitcoin has seen massive growth in take-up and price. However, to some, the world of cryptocurrency may seem too expensive to access. The costs of traditional bitcoin mining require significant investment before you get any reward. Contrary to this belief, there are several ways in which bitcoin enthusiasts can earn free crypto income without investment. So, how can you access free bitcoin mining without investment?

The best way to get a significant amount of bitcoin is to buy and trade it. But free bitcoin does exist and can be earned through various means. While many involve effort to obtain them, they are still free. This makes it less risky when you aren’t investing your money.

Free bitcoin is real and legitimate; however, this does not imply that you can’t be scammed. It is still important to be vigilant for what could turn out to be a scam.

There are several ways to get free bitcoin, including faucets and cloud mining platforms. Free mining is definitely a reality, despite the assumptions by many that it is an expensive game. Numerous cloud mining platforms, plus bitcoin faucets, which send out small quantities of bitcoin regularly, make it more accessible.

You can get free bitcoin mining without investment, but how?

One way to mine bitcoin without dedicated equipment is to install a mining browser. This uses the power of your computer to get bitcoins, which you can then retrieve. One such example of such a browser is CryptoTab, however, there are dangers to software like this. Besides the potential to slow down your computer, there are warnings about the damage this could do to your CPU. There is the potential for it to overwork your computer.

There are, however, alternatives to using your CPU’s power to mine cryptocurrency. Cloud Mining tools, such as StormGain, a zero commission mining platform, is one option available for those who wish to earn free income from bitcoin mining. Instead of charging fees upfront, Stormgain takes a small percentage of the proceeds of your mining. You get the rest — a small price to pay for a significant gain.

The platform, at more of a cost, offers cryptocurrency trading, as well as its cloud mining services. While there are alternatives, it is not clear that they are completely free, potentially involving some initial costs.

An alternative to StormGain is Cointiply, which, while not requiring investment, may require you to carry out small tasks. This will reward you with amounts of cryptocurrency for doing surveys and tasks. Alternatively, they have a bitcoin faucet, which gives you an amount every hour. The platform has paid over $3 million in bitcoin since starting up. Cointiply also pay you a 1% bonus for each day that you are active on it.

Is it possible to earn one bitcoin completely free? This, although difficult, is possible over a time period.

In conjunction with doing tasks and playing games, faucets can lead you to get your first bitcoin. It may take some patience, but it can get you there.

Alternatively, if you aren’t that patient, there is the odd competition that has bitcoin as the prize. Be cautious, though, as not all of these are genuine. This, if genuine, would be the fastest way to get 1 bitcoin by far. However, if you see a big flashing ad saying one free bitcoin — proceed with caution. These can be and often are scams.

If you are looking for free bitcoin mining without investment, some of these options may work for you.

Depending on how much you are willing to put in that isn’t actual money, what counts as the best may vary. For those willing to work for it, Cointiply is the best to mine and accumulate bitcoin through tasks, faucets, and games.

Besides this, if you prefer a completely hands-off approach, Bitland.pro may be the best option. Offering regular automatic withdrawals to your wallet, as well as bonuses regularly, this cloud miner may work for those who don’t mine as their main focus. It also offers the option of paid plans, but this is up to personal choice.

Despite the benefits of free mining, there are other avenues. If you’re not rushing to gain bitcoin and just want daily income, your best option is faucets. These are websites that send out small amounts of bitcoin on a regular (usually hourly or every few minutes) basis. These faucets will either have their own wallets or may ask for an address where the bitcoin will be sent.

Those with their own wallets offer the facility to withdraw the crypto to your wallet. It may be beneficial to leave your bitcoin in the wallet of your faucet, particularly if they offer an interest-earning account. One such website that offers this is FreeBitco.in. Among other features, the faucet offers interest on your bitcoin at 4.08%, but even so, you need plenty of cryptocurrencies to make it worth it.

The diff8888888iculty with faucets is working out the tax on your bitcoin income. Since governments have cracked down on cryptocurrency regulation, this has become a necessity to keep track of your bitcoin gains, but this doesn’t make it impossible.

There are benefits and downsides to all these methods. It depends on the amount of effort and time you put into earning free bitcoin. The general rule when it comes to this is that the more effort you put in, the greater your return. Despite this, if you are willing to wait for considerable amounts of free bitcoin, the best option would be a faucet, sending out small amounts of bitcoin at regular intervals.

These are great options to earn free bitcoin mining income without investment, however, for ease and the lower risk, faucets serve as the better option.

When Bitcoin sets new price records every day, and at the moment it costs below $40,000 (May 2021), the question of how to earn Bitcoin is more relevant than ever.

Naturally, the freeways to get Bitcoin presented below will not bring you a lot of money. However, if you have some free time and a desire to earn some bitcoin, these methods will be relevant for you.

Taking into account the growth of the exchange rate, the earned coins for $10,000 would now be valued at 4 times more expensive (if take into account periodic outbreaks due to tweets by Elon Musk, then all 6 times more expensive)

Bitcoin Faucets

Faucets are platforms that reward visitors or users with free cryptocurrencies when they complete certain tasks. This simple task can be anything from simple captcha typing, watching ads, playing online games, online quizzes, and taking surveys. The rewards are presented in satoshi. Satoshi is the smallest unit of bitcoin, equivalent to the 100 millionth part of bitcoin. 1 satoshi = 0.00000001 bitcoin.

Here are some popular bitcoin faucets that allow getting free bitcoin and other crypto:

Cointiply

BonusBitcoin

FreeBitco.in

Freebitcoin.io

FreeFaucetSatoshi Labs

Firefaucet

CoinPayU

Satoshi hero

BTCBux

More and more legal sites appear every day. Often, services that pay tokens for viewing advertising content offer users not only to watch videos but also perform several simple tasks: read letters, surf, enter captchas. An important point is that each platform has its withdrawal limits. Usually at least 10,000 satoshi, it will be difficult for a beginner to earn such an amount quickly.

Image source

Bitcoin Games

Various games allow you to receive cryptocurrency for free. For example, Rollercoin presents you with ten simple games that have been known to everyone for a long time. It is easy and interesting to pass the levels of these games.

Even if you did not cope with the task, Rollercoin credits you with power – so-called hashrate. Using this power, you can simulate crypto mining right inside the game.

A few weeks ago I made a video where I tried mining bitcoin for a week and was truthfullyjust absolutely mind blown and very much so intrigued by the potential of this businessWell in this video we’re gonna go over a few things I missed in that video, where I’mat a month later, we’re gonna talk about me buying tens of thousands of dollars ofthe wrong kind of equipment, bitcoin price dropping by like half after I already boughtthe wrong equipment and so much moreOk quick recap I built up

Hello everybody!In this video, I’ll tell you about Bitcoin – what it is, how to mine it, and what bitcoin

you how to earn free Bitcoin using the best Bitcoin mining app for beginnersthis year 2021.How to do it?We’re about to find out.This is how to earn free Bitcoin!Also, only a